Purchasing Fixed Assets

For purchasing a new asset:

- Create an Asset Category

- Create a related Item with ‘Is Fixed Asset‘ enabled for creating the asset.

- You may also enable ‘Auto Create Assets on Purchase‘ for creating assets automatically. (Optional)

- Then, the purchase cycle should be followed for purchasing an asset.

- Enter the Asset Location in the Items table of the Purchase Receipt or Purchase Invoice through which you are receiving the item.

- On submission of a Purchase Receipt, based on auto creation checkbox, Asset records will be created automatically. You can then enter other details of the Asset manually from the Asset form.

Following accounting entries will be posted on submission of the Receipt entry if Capital Work In Progress Accounting is enabled in the Asset Category of the purchased asset.

It is noticeable here that, instead of corresponding asset account, Capital Work in Progress (CWIP) has been debited. This is because the asset has only been purchased and it is still not available for use. Until the asset is available for use, the asset value is maintained against this account. On the day when it is available for use, the CWIP account gets credited and corresponding asset account gets debited.

In case of disabled ‘Capital Work In Progress Accounting’ in the Asset Category, the receipt entry will be made against corresponding asset accounts set in the Asset Category.

ERPNext also uses a temporary account “Asset Received But Not Billed” (a liability account) which gets credited on submission of Purchase Receipt entry. Later, on submission of Purchase Invoice, this account gets debited/reversed.

Reference: Purchasing an Asset | ERPNext Documentation

Selling Fixed Assets

Preparation:

- Create a Gain/Loss on Asset Disposal account: Expense account 530.000 Biaya Penyusutan > 5310.003 Rugi atas Pelepasan Aktiva Tetap. (actually it can be Income account)

- In Company > Lovia, set Fixed Asset Depreciation Settings > Gain/Loss Account on Asset Disposal: 5310.003 Rugi atas Pelepasan Aktiva Tetap.

Now you’re ready to sell assets.

- Go to the asset and click Sell Asset.

This will create a Sales Invoice. - In item’s detail, set the Rate (selling price).

Make sure Income Account and Expense Account are correct, both can be set to 5310.003 Rugi atas Pelepasan Aktiva Tetap. - Submit the Sales Invoice. This will create:

1211.001 Aktiva Perlengkapan dan Peralatan Kantor (Credit) =>

1131.0010 Piutang Dagang + 5310.003 Rugi atas Pelepasan Aktiva Tetap (Debit) - Create the Payment (Receive) for the Sales Invoice and Submit it.

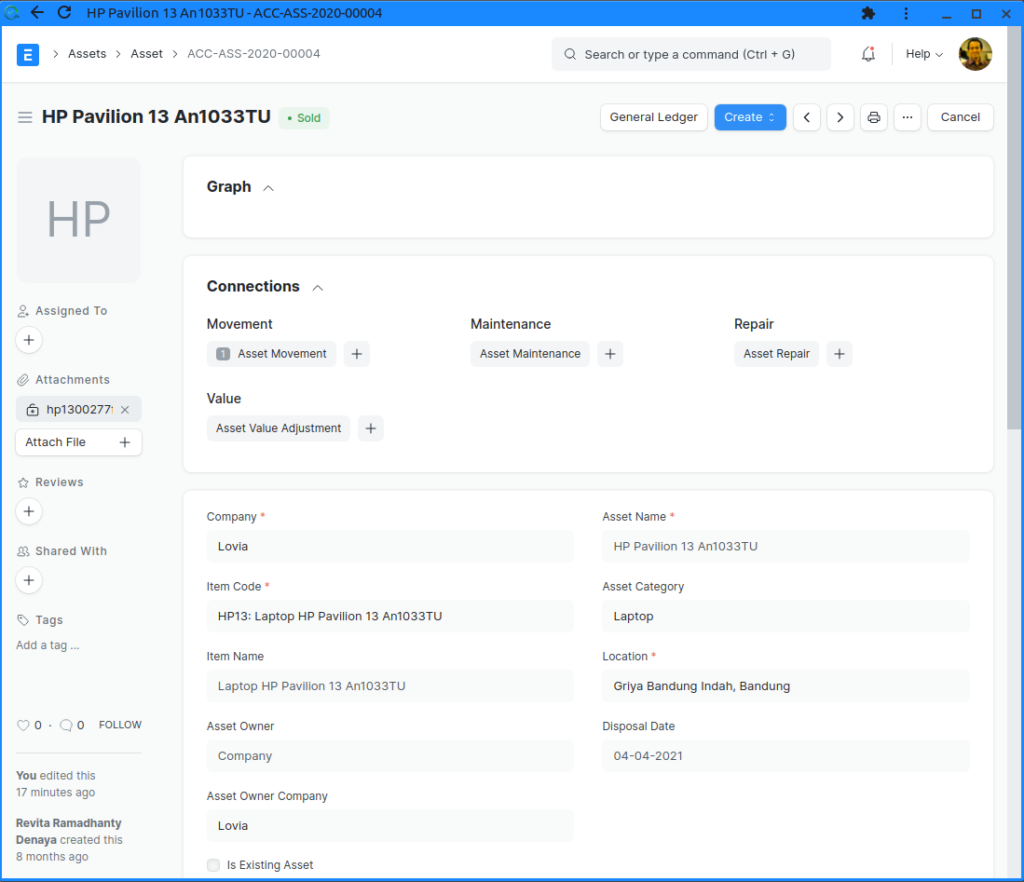

The Asset document status will have changed to Sold: